Forex traders often say that “The trend is your friend” because a market uptrend or downtrend provides several reliable opportunities to catch pips. During these kinds of market behavior, trend lines and channels can be the most reliable technical analysis tools.

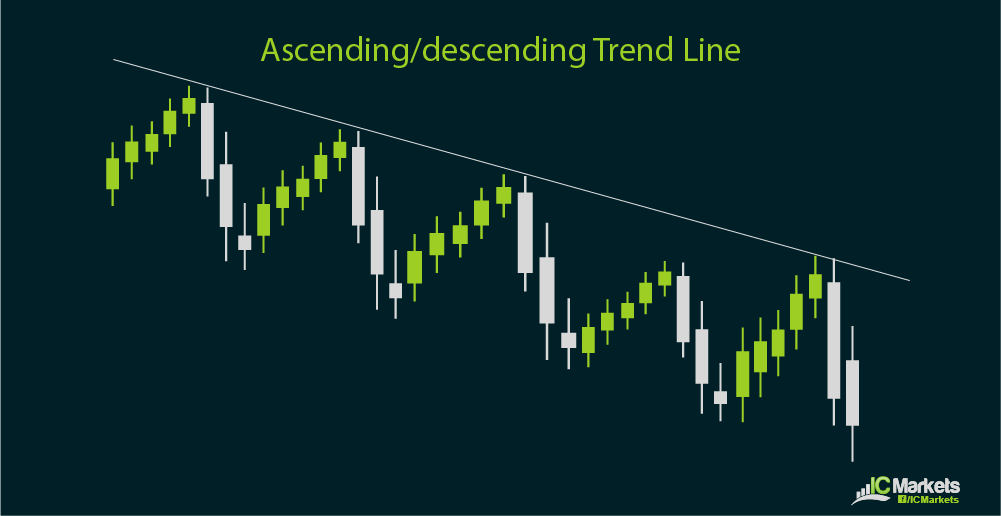

Trend lines are drawn simply by connecting the recent highs or lows of price action. To be specific, an uptrend line or ascending trend line is drawn by connecting the latest lows with a straight line. A downtrend line or descending trend line is created by connecting the latest highs with a straight line.

An ascending trend line tends to act as support for price action if the uptrend continues. Price often pulls back to the rising support level and bounces if buying momentum remains strong. The creation of new highs indicates that the uptrend will carry on.

On the other hand, a descending trend line is treated as resistance for price action if the downtrend is strong. Price often pulls back to the falling resistance level and bounces if selling momentum carries on. The formation of new lows suggests that the selloff is likely to continue.

As with other types of inflection points, a break above the falling trend line resistance indicates that the downtrend may be over and that a reversal could take place. Conversely, a break below a rising trend line support suggests that the uptrend is about to turn.

Channels are simply trend lines drawn parallel to one another. In particular, an ascending channel is formed when the rising trend line connecting the lows of recent price action has a parallel rising trend line connecting the latest highs. A descending trend channel is created by drawing a trend line connecting the latest highs and having a parallel downtrend line connecting the latest lows.

Channels tend to be more potent trade signals since these could also provide potential take-profit levels. Trend-following traders could enter trades in the same direction of the overall market trend, which means shorting at the top of the falling channel or going long at the bottom of a rising channel. Countertrend traders could enter trades in the opposite direction of the channel trend, which means going long at the bottom of a falling channel or shorting at the top of a rising channel.

Of course, countertrend trades tend to be a little more risky while trend-following setups do have a higher probability of winning. Traders often look for confluence or the lining up of several kinds of inflection points for confirmation before deciding to jump in a countertrend setup.